Tell-Tale Signs: Your Role in Preventing Money Laundering by Flagging it Up

3 January, 2018 | News Releases

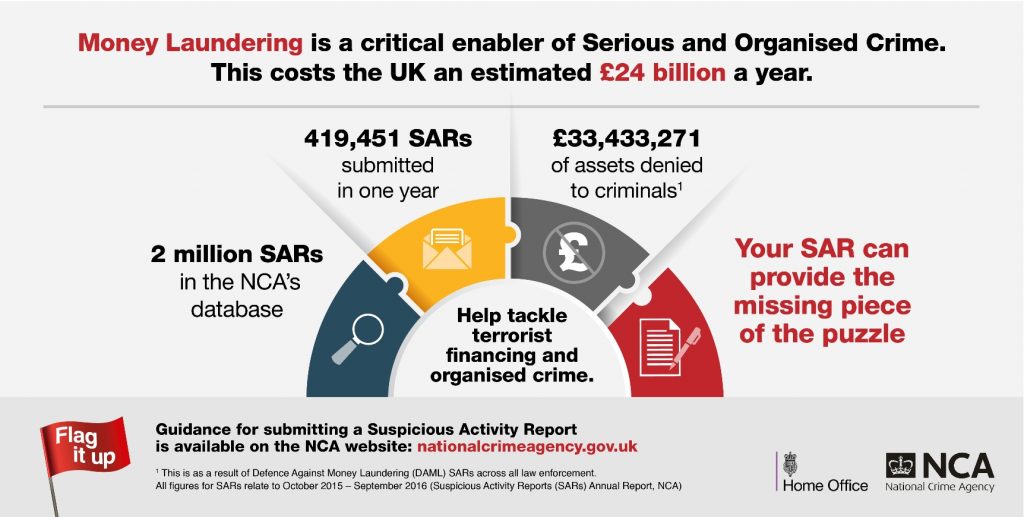

Serious and organised crime costs the UK an estimated £24bn a year and money laundering not only allows criminals to hide the proceeds of their crimes, but helps fund further criminal activity. In its latest report, the Government has set out the threats posed by money laundering and is relaunching the Flag it Up campaign to raise awareness and show how you can help stamp it out.

Headed by the National Crime Agency, Flag it Up is a joint campaign, between the Government, the legal and accountancy sectors that aims to raise awareness of the tell-tale signs of money laundering and the risks for firms and professionals from being caught in this financial crime.

Elizabeth Baker, Head of Proceeds of Crime at the Serious Fraud Office, spoke to Flag it Up about the tell-tale signs of money laundering and how you can help catch criminals trying to commit it through using Suspicious Activity Reports (SARs).

Tell-Tale Signs: It’s time to Flag it Up!

- A long term client starts making requests that are out of character

- A client repeatedly asking for services outside your or your firm’s area of expertise

- A client requesting arrangements that do not make commercial sense

Ignoring suspicious activity puts you and your firm at risk and fuels further crime. Remember: Flag it Up!

SARs are the missing piece of the intelligence puzzle that you can provide. SARs are critical in tackling money laundering, serious and organised crime, corruption and fraud and provide valuable information from the private sector that would otherwise be invisible to law enforcement.

SARs can often provide immediate opportunities to stop crime, arrest offenders or freeze assets and crucially contribute to the UK’s overall ability to assess and fight the threats from economic crime. The more information and intelligence provided, the easier it is for law enforcement to identify methods used by criminals and proactively take steps to catch perpetrators and protect the public.

Failing to take action over suspicious activity could result in you or your firm being subject to a criminal investigation. Even if charges are not brought, you could spend significant time answering questions from law enforcement or regulators and away from your other clients. Worse still, an investigation could result in serious reputational damage if suspected criminal activity is confirmed and could have far reaching commercial impacts if you are no longer able to bid for certain types of contracts.

In June 2017, the UK government implemented the Fourth Money Laundering Directive, this strengthened the UK’s already strong anti-money laundering legislation and ensured we are keeping pace with the changing face of financial crime. However, only if those in the legal and accounting sectors continue submitting the crucial SARs we need to close intelligence gaps, can we shut down the criminal networks that support serious and organised crime for good.

Ignoring suspicious activity puts you and your firm at risk and fuels further crime. Remember: Flag it Up!

You can make a Suspicious Activity Report through the National Crime Agency by following this guidance here.